Saudi Arabia Commercial Real Estate Market Set to Reach USD 91.87 Billion by 2032

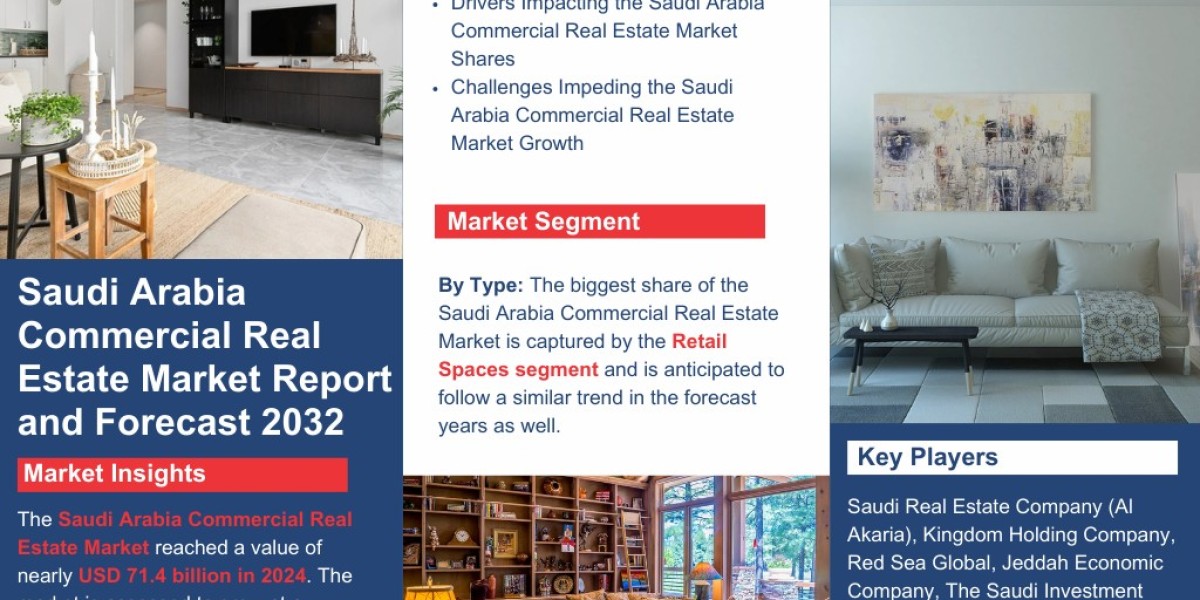

The Saudi Arabia Commercial Real Estate Market has demonstrated remarkable resilience and growth potential, valued at approximately USD 71.4 billion in 2024. According to a comprehensive analysis by The Report Cube, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of around 4.1% during the forecast period of 2025-2032, potentially reaching USD 91.87 billion by 2032.

Market Analysis

- Vision 2030 Implementation: Saudi Arabia's ambitious economic diversification plan continues to drive commercial real estate development, particularly in non-oil sectors like tourism, entertainment, and technology.

- Foreign Investment Surge: Recent regulatory reforms have eased restrictions on foreign ownership, attracting international investors and developers to the Saudi commercial property market.

- Smart City Initiatives: Projects like NEOM and Red Sea Project incorporate cutting-edge technologies and sustainable design principles, setting new standards for commercial developments.

- Post-Pandemic Recovery: The market has rebounded strongly following COVID-19 disruptions, with office spaces being redesigned to accommodate hybrid work models.

- Government Infrastructure Investment: The Public Investment Fund (PIF) continues to allocate significant capital toward developing commercial districts and business hubs across major cities.

- Rising Demand for Grade-A Office Space: Premium office facilities with modern amenities and sustainability features command higher leasing rates and occupancy levels.

Get a Free Sample Report- https://www.thereportcubes.com/request-sample/saudi-arabia-commercial-real-estate-market

Key Takeaways from the Market Research Report

- Diversification Beyond Traditional Sectors: The market is expanding beyond conventional commercial properties to include specialized facilities like data centers, life sciences buildings, and mixed-use developments.

- ESG Compliance Driving Premium Values: Properties adhering to Environmental, Social, and Governance standards command higher valuations and attract quality tenants.

- Technological Integration: Smart building technologies, IoT solutions, and digital infrastructure have become essential components of new commercial developments.

- Retail Transformation: Shopping centers are evolving into experiential destinations, incorporating entertainment, dining, and community spaces to counter e-commerce competition.

- Logistics Boom: The rapid growth of e-commerce has intensified demand for modern warehousing and distribution facilities, particularly around major urban centers.

- Public-Private Partnerships: Collaborative ventures between government entities and private developers are accelerating large-scale commercial projects.

The Saudi Arabia commercial real estate market stands at a pivotal juncture, balancing traditional growth factors with innovative approaches to property development and management, positioning itself as a dynamic investment opportunity in the Middle East region.

Read Full Report - https://www.thereportcubes.com/report-store/saudi-arabia-commercial-real-estate-market

Leading Market Players

- Dar Al Arkan Real Estate Development Company

- Saudi Real Estate Company (Al Akaria)

- Jabal Omar Development Company

- Emaar The Economic City

- Tadawul Real Estate Company

- Arabian Centres Company

- Arriyadh Development Authority

- Al Rajhi Capital

- Amlak International for Real Estate Finance

- SEDCO Holding Group

Focus on Sustainability and Innovation

One of the most significant market drivers is the increasing emphasis on sustainable building practices and technological innovation. Saudi commercial properties are rapidly adopting green building standards, renewable energy solutions, and smart building management systems. This shift is driven by both regulatory requirements and tenant preferences, as multinational corporations increasingly prioritize environmentally responsible facilities for their operations. The Saudi Green Initiative has further accelerated this trend, offering incentives for developers who incorporate sustainability features like solar panels, energy-efficient systems, and water conservation measures. These properties typically command 15-20% higher rental premiums while reducing operational costs by up to 30% compared to conventional buildings.

Leading Segment: Office Spaces

The office segment continues to dominate the Saudi commercial real estate market, accounting for approximately 38% of the total market value. Major cities like Riyadh and Jeddah are experiencing a surge in demand for Grade-A office spaces that offer flexible configurations, advanced digital infrastructure, and wellness amenities. The shift toward hybrid work models has not diminished the importance of office spaces but rather transformed requirements toward collaborative environments that support innovation and team cohesion. Financial services, technology companies, and professional services firms remain the primary occupiers, with average lease terms extending to 5-7 years compared to the previous 3-5 year standard, reflecting growing confidence in the market's stability.

Regional Market Insights

Riyadh stands as the epicenter of commercial real estate growth in Saudi Arabia, capturing approximately 42% of total investment in the sector. The capital city has benefited tremendously from the "Riyadh Strategy 2030" initiative, which aims to transform it into one of the world's top ten city economies. Notable developments include the King Abdullah Financial District and the Riyadh Front, which have established new benchmarks for premium commercial spaces. Additionally, the city's expanding metro system has created valuable development opportunities around transit nodes, driving up property values in these connected corridors by an average of 25-30% compared to similar properties in less accessible locations.

About The Report Cube

The Report Cube is a leading market research firm specializing in comprehensive industry analyses across global markets. With a team of experienced analysts and consultants, the company delivers actionable insights that help businesses make informed strategic decisions. Their research methodology combines primary and secondary research techniques with advanced data analytics to provide accurate market projections and detailed competitive intelligence. The Report Cube serves a diverse client base including Fortune 500 companies, investment firms, and government agencies seeking reliable market intelligence to navigate complex business landscapes.