The financial industry is rapidly evolving, and banks along with NBFCs must adapt to stay ahead. CredAcc’s Loan Management System offers an advanced, API-first platform that automates the entire lifecycle of MSME loans. By streamlining loan servicing, repayment tracking, and collections, this system empowers financial institutions to operate more efficiently and effectively.

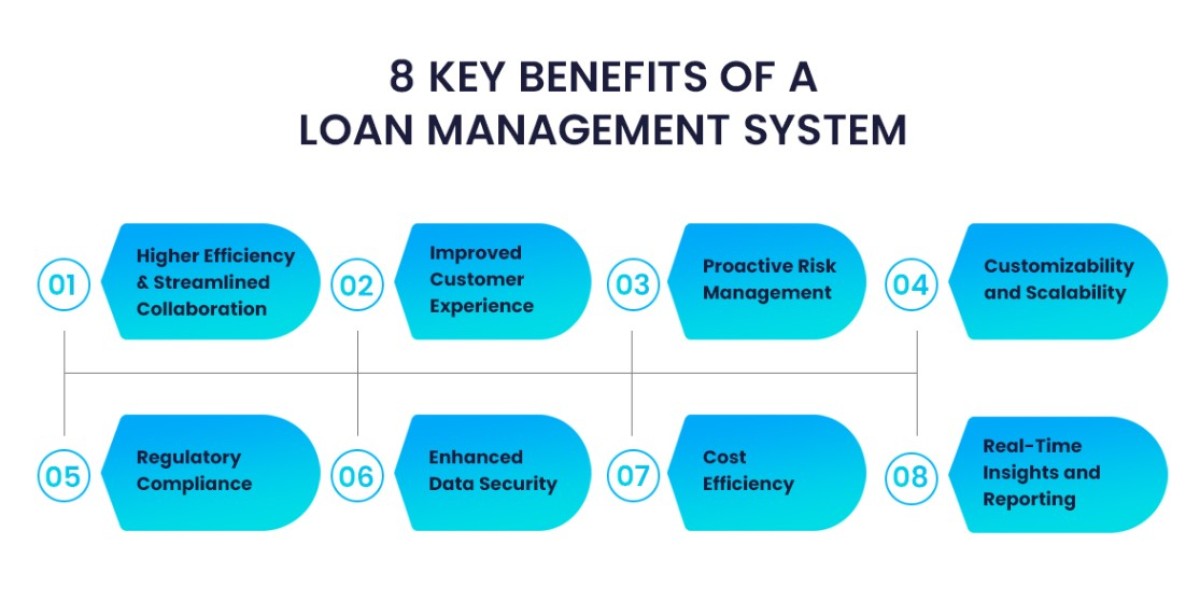

One of the primary advantages of this Loan Management System is its seamless integration capability. Designed to work with your existing banking software, it ensures that all loan transactions are processed in real time. This integration not only simplifies workflow management but also enhances data accuracy and security by eliminating manual errors.

Automation plays a central role in this system. With tasks like repayment reminders, installment calculations, and post-disbursal collections being managed automatically, banks can focus more on strategic growth rather than day-to-day administration. The real-time monitoring features provide constant oversight, enabling lenders to track loan performance and receive immediate alerts if repayments are delayed or defaults occur.

Flexibility is another significant benefit. The loan management system is highly configurable, allowing financial institutions to customize processes according to their unique requirements. Whether it's adjusting payment schedules, setting up tailored reporting, or implementing specific compliance protocols, the system adapts to meet the diverse needs of each lender.

Enhanced customer satisfaction is a natural outcome of improved operational efficiency. Borrowers benefit from timely notifications and transparent processes, which build trust and encourage prompt repayments. The automated nature of the system minimizes delays and errors, ensuring that every transaction is processed swiftly and accurately.

Robust security measures are built into every layer of the platform. With secure data handling practices and compliance with industry regulations, CredAcc’s Loan Management System offers peace of mind for both lenders and borrowers. This focus on security is essential for maintaining the integrity of sensitive financial data.

Ultimately, CredAcc’s Loan Management System represents a significant leap forward in how financial institutions manage MSME loans. By automating manual processes, integrating seamlessly with existing systems, and offering customizable and secure solutions, this system enables banks and NBFCs to achieve operational excellence. Embrace this advanced platform to reduce costs, improve recovery rates, and deliver an enhanced customer experience in today’s competitive financial market.