Aluminium is one of the most widely used metals globally, crucial for industries ranging from aerospace and automotive to construction, packaging, and electronics. As one of the most traded metals in the world, its price is subject to a variety of economic, geopolitical, and environmental factors. Forecasting aluminium prices requires an understanding of current market conditions, historical trends, and the key drivers that influence supply and demand dynamics.

This article explores the aluminium price forecast by examining the current trends, factors affecting pricing, and potential market shifts that could impact the metal's future value.

1. Overview of the Aluminium Market

Aluminium is a non-ferrous metal known for its lightweight, corrosion-resistant properties, and excellent conductivity, making it highly desirable in industries like transportation, construction, and consumer goods. The global aluminium market is influenced by two major segments:

- Primary Aluminium: Aluminium that is produced directly from bauxite through processes like the Bayer and Hall-Héroult processes.

- Secondary Aluminium: Recycled aluminium obtained from scrap metal, which reduces energy consumption and environmental impact.

Aluminium is traded on major exchanges like the London Metal Exchange (LME), and its price is typically quoted in U.S. dollars per tonne.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/aluminum-price-trends/pricerequest

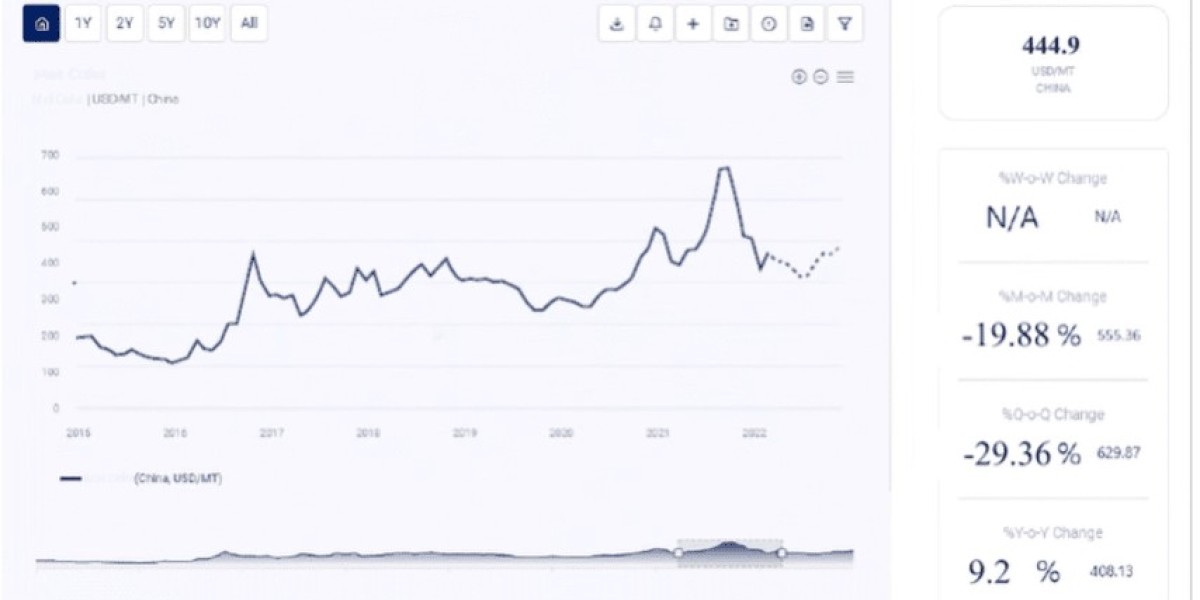

2. Historical Price Trends

To forecast aluminium prices, it's essential to consider past price movements. Historically, aluminium prices have experienced considerable fluctuations due to changes in global economic conditions, technological advancements, and shifting industrial demand.

- 2000s and 2010s Price Volatility: The 2000s saw a significant rise in aluminium prices driven by global industrial growth, particularly in China. However, the prices fell drastically during the 2008 financial crisis, which caused a sharp reduction in global demand. Prices began to recover in the early 2010s due to increased industrial activity, particularly in Asia.

- 2017-2020 Surge: Prices rose again as demand from key industries, particularly automotive and construction, increased. During this period, geopolitical tensions, such as trade wars, and changes in China's production capacity, had a substantial effect on prices.

- 2021-2023 Supply Chain Disruptions: Aluminium prices reached their highest levels in over a decade in 2021, influenced by global supply chain disruptions, rising energy costs, and growing demand for the metal in green energy technologies and electric vehicles. However, prices experienced some volatility due to fluctuations in global production and trade policies.

3. Key Drivers of Aluminium Price Movements

Several factors affect aluminium prices, and understanding these drivers is crucial for accurate price forecasting:

3.1 Global Demand and Economic Growth

The overall demand for aluminium is strongly correlated with global economic growth. Key sectors that drive aluminium consumption include:

- Automotive: Aluminium is widely used in automotive manufacturing for lightweighting, improving fuel efficiency, and reducing carbon emissions. The shift towards electric vehicles (EVs) and greener transportation technologies is expected to significantly boost aluminium demand.

- Construction: Aluminium's corrosion resistance and lightweight properties make it ideal for construction materials, particularly in infrastructure, residential, and commercial projects.

- Electronics and Packaging: The growth in consumer electronics and the packaging industry (especially in food and beverages) also contributes to higher aluminium demand.

Emerging economies like China and India, as well as growth in green technologies, will continue to influence overall demand for aluminium.

3.2 China’s Role in the Aluminium Market

China is the world's largest producer and consumer of aluminium, making it a crucial player in the global aluminium market. As of recent years, China accounts for more than half of the global demand for aluminium and nearly half of its production.

China’s policies, including restrictions on energy-intensive industries, capacity expansions, or trade regulations, can significantly impact aluminium prices. For example, any decision to cut production or increase tariffs on imports could cause price fluctuations across global markets.

3.3 Energy Prices and Production Costs

Aluminium production is energy-intensive, requiring large amounts of electricity to extract the metal from bauxite ore. Therefore, changes in energy prices (particularly natural gas and electricity) have a direct impact on production costs and, subsequently, aluminium prices.

Regions with cheap energy, such as the Middle East or Russia, benefit from lower production costs and are often able to offer more competitive prices. On the other hand, energy price spikes, such as those experienced during the global energy crisis of 2021, can significantly raise the cost of production and influence aluminium prices.

3.4 Geopolitical Factors and Trade Policies

Geopolitical tensions, trade disputes, and tariffs can create uncertainty and volatility in the aluminium market. For example, the US-China trade war resulted in the imposition of tariffs on aluminium products, which disrupted global supply chains and created price fluctuations.

Additionally, sanctions on key producers like Russia and trade barriers in critical regions can disrupt aluminium production and influence pricing dynamics globally.

3.5 Recycling and Secondary Aluminium

The recycling of aluminium plays a significant role in the supply side of the market. Secondary aluminium (recycled aluminium) offers a lower-cost and more environmentally friendly alternative to primary aluminium. As recycling technologies advance and the demand for sustainable materials rises, the role of secondary aluminium in the market will increase. This may help stabilize prices by providing a more reliable supply of aluminium.

3.6 Environmental and Sustainability Concerns

Environmental regulations and the growing demand for sustainability in manufacturing processes are increasingly influencing the aluminium market. Aluminium is one of the most recyclable metals, and its production from recycled material uses significantly less energy compared to primary production.

As sustainability concerns rise, companies and industries are more likely to invest in environmentally friendly aluminium production methods. This trend could help mitigate cost increases and offer more stable prices in the long term.

4. Aluminium Price Forecast: Short-Term and Long-Term Outlook

4.1 Short-Term Aluminium Price Outlook (2023-2025)

In the short term, aluminium prices are expected to remain volatile due to various factors:

- Post-Pandemic Recovery: As the global economy continues to recover from the impacts of COVID-19, industrial demand for aluminium is expected to increase, particularly in automotive, construction, and green energy sectors. The electric vehicle market, in particular, is projected to see significant growth, boosting demand for aluminium.

- Supply Chain Issues: Ongoing disruptions in supply chains, particularly in China, as well as energy price fluctuations, are expected to continue to affect aluminium production costs. If production in key regions remains constrained, prices may see upward pressure.

- Geopolitical Risks: Tensions in major aluminium-producing regions, including trade restrictions and sanctions on key producers like Russia, will remain a risk factor, contributing to price volatility.

4.2 Long-Term Aluminium Price Outlook (2025-2030)

Looking further into the future, the outlook for aluminium prices will largely depend on the following factors:

- Electric Vehicle Growth: As the shift towards electric vehicles accelerates, aluminium demand is expected to grow significantly, as it is a key material in EV production for lightweighting purposes. The aluminium market is likely to see sustained growth as manufacturers increase their reliance on the metal for this purpose. This growth will likely influence the aluminium slug price trend, as the demand for slugs in battery casings and other parts of electric vehicles increases.

- Energy Transition and Green Technologies: Aluminium’s role in renewable energy technologies, such as solar panel production and energy storage systems, will also contribute to increasing demand. The metal is likely to play a pivotal role in the global transition to greener energy, providing support for long-term price growth. As demand for aluminium slugs rises for applications in energy storage and solar panel technology, the aluminium slug price trend could follow a similar upward trajectory.

- Recycling Efficiency: As recycling technologies improve and the use of secondary aluminium increases, production costs may decrease, stabilizing price fluctuations. The move towards more sustainable aluminium production methods could support a more predictable pricing structure in the future. Increased recycling efforts may positively influence the aluminium slug price trend by providing a more stable supply and reducing dependence on primary aluminium production.

Looking further into the future, the outlook for aluminium prices and the aluminium slug price trend will largely depend on the following factors:

The aluminium price forecast is subject to a variety of complex factors, including global demand for industrial products, geopolitical risks, energy costs, and sustainability efforts. While short-term price volatility is expected due to supply chain disruptions, geopolitical uncertainties, and rising energy costs, the long-term outlook for aluminium prices remains bullish, driven by the growing demand for the metal in green technologies, electric vehicles, and global infrastructure projects.

As industries continue to prioritize sustainability and innovation, aluminium is expected to remain a critical material in the future, with demand outpacing supply in the years ahead. The forecast for aluminium prices suggests that while there will be periods of volatility, overall price trends are likely to be upward in the medium to long term, especially with the ongoing transition to greener energy and a more sustainable global economy.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA