The artificial insemination market is experiencing significant growth, driven by increasing infertility rates, lifestyle changes, and advancements in reproductive technologies. In 2024, the market was valued at USD 2.40 billion, and it is expected to grow at a CAGR of 8.60%, reaching approximately USD 5.48 billion by 2034.

This article provides a comprehensive overview of the artificial insemination market, exploring its size, trends, segmentation, key growth factors, recent developments, competitor analysis, and frequently asked questions (FAQ). If you’re looking for insights into the future of artificial insemination, keep reading!

Artificial Insemination Market Overview

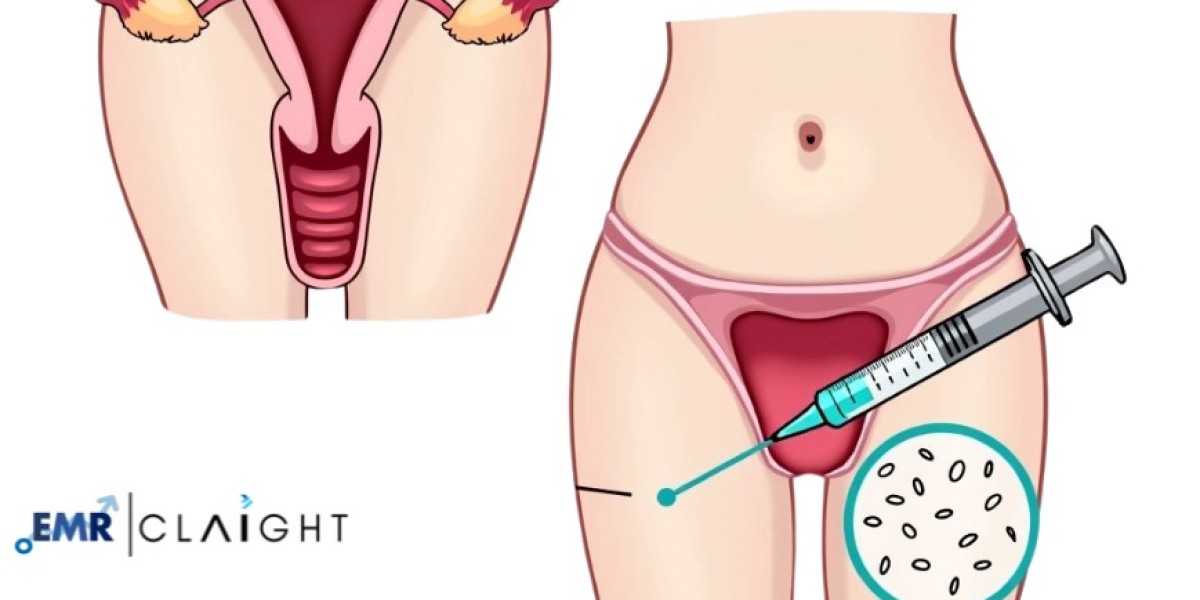

Artificial insemination (AI) is a widely used assisted reproductive technology (ART) that involves the direct introduction of sperm into a woman’s reproductive tract to achieve pregnancy. It is commonly used for treating infertility in both humans and animals.

The market has been growing steadily due to increasing awareness, rising cases of infertility, delayed pregnancies, and technological advancements in reproductive health. The availability of cost-effective fertility treatments and an increase in single parents and same-sex couples opting for assisted reproduction further contribute to market expansion.

Artificial Insemination Market Size

- Market Value in 2024: USD 2.40 billion

- Projected Market Value in 2034: USD 5.48 billion

- CAGR (2025-2034): 8.60%

The artificial insemination market is expected to see substantial growth over the next decade due to a surge in fertility clinics, increasing medical tourism, and advancements in sperm freezing and storage technologies.

Artificial Insemination Market Trends

Several trends are shaping the artificial insemination industry:

Rising Infertility Rates

Factors such as stress, pollution, unhealthy lifestyles, and hormonal imbalances are contributing to the increasing prevalence of infertility worldwide. This has led to higher demand for ART solutions like artificial insemination.

Technological Advancements in Reproductive Medicine

Innovations such as cryopreservation, sperm sorting techniques, AI-assisted fertility monitoring, and genetic screening are improving the success rates of artificial insemination procedures.

Growing Demand for Fertility Treatments Among Same-Sex Couples and Single Parents

More LGBTQ+ individuals and single parents are turning to artificial insemination as an alternative to traditional conception methods, boosting market growth.

Increase in Medical Tourism

Countries with affordable and advanced fertility treatments, such as India, Thailand, and Mexico, are attracting international patients, fueling market expansion.

Rising Government and Private Sector Investments

Governments and private healthcare providers are investing in fertility clinics, awareness campaigns, and insurance coverage for reproductive treatments.

Get a Free Sample Report with Table of Contents

Artificial Insemination Market Segmentation

By Type of Procedure:

- Intrauterine Insemination (IUI) – The most commonly used AI method.

- Intracervical Insemination (ICI) – A less invasive and cost-effective alternative.

- Intravaginal Insemination (IVI) – Often performed at home using donor sperm.

- Intratubal Insemination (ITI) – Used in specific fertility cases.

By End-User:

- Fertility Clinics – Major providers of artificial insemination services.

- Hospitals – Offering AI as part of broader reproductive health services.

- Home Settings – Increasing use of at-home insemination kits.

By Sperm Source:

- Donor Sperm – Used when male infertility is a concern.

- Partner Sperm – Common in couples facing conception challenges.

By Region:

- North America – Largest market due to advanced healthcare and rising infertility rates.

- Europe – Strong presence of fertility clinics and government-backed ART programs.

- Asia-Pacific – Fastest-growing region due to increasing awareness and medical tourism.

- Latin America & Middle East – Emerging markets with growing fertility treatment adoption.

Artificial Insemination Market Growth Factors

- Delayed Pregnancies – More women are choosing to conceive later in life, increasing the need for artificial insemination.

- Advancements in AI and Robotics – AI-driven analysis is improving fertility treatments.

- Expanding Insurance Coverage for Fertility Treatments – More insurers are covering ART procedures.

- Rising Demand for At-Home Insemination Kits – Greater accessibility and convenience for users.

- Improved Success Rates – Scientific advancements have enhanced pregnancy success rates with artificial insemination.

Recent Developments in the Artificial Insemination Market

AI-Powered Fertility Tracking

Companies like Vitrolife Inc. are integrating AI and machine learning to predict the best insemination timing.

Launch of New At-Home Insemination Kits

Rinovum Women’s Health, Inc. has introduced innovative home-based fertility solutions.

Partnerships & Acquisitions

Genea Ltd. has expanded through acquisitions, increasing its market footprint.

Advancements in Sperm Freezing Technologies

Fujifilm Irvine Scientific, Inc. has developed cutting-edge cryopreservation techniques.

Competitor Analysis

Vitrolife Inc.

- Leading provider of AI-integrated fertility solutions.

- Specializes in cryopreservation and in vitro fertilization (IVF) tools.

Rinovum Women’s Health, Inc.

- Focuses on at-home artificial insemination kits.

- Expanding its reach through direct-to-consumer sales.

Genea Ltd.

- A pioneer in cutting-edge reproductive technologies.

- Strong presence in Europe and Asia-Pacific.

Fujifilm Irvine Scientific, Inc.

- Innovations in sperm analysis and cryopreservation.

- Expanding in the North American and Asian markets.