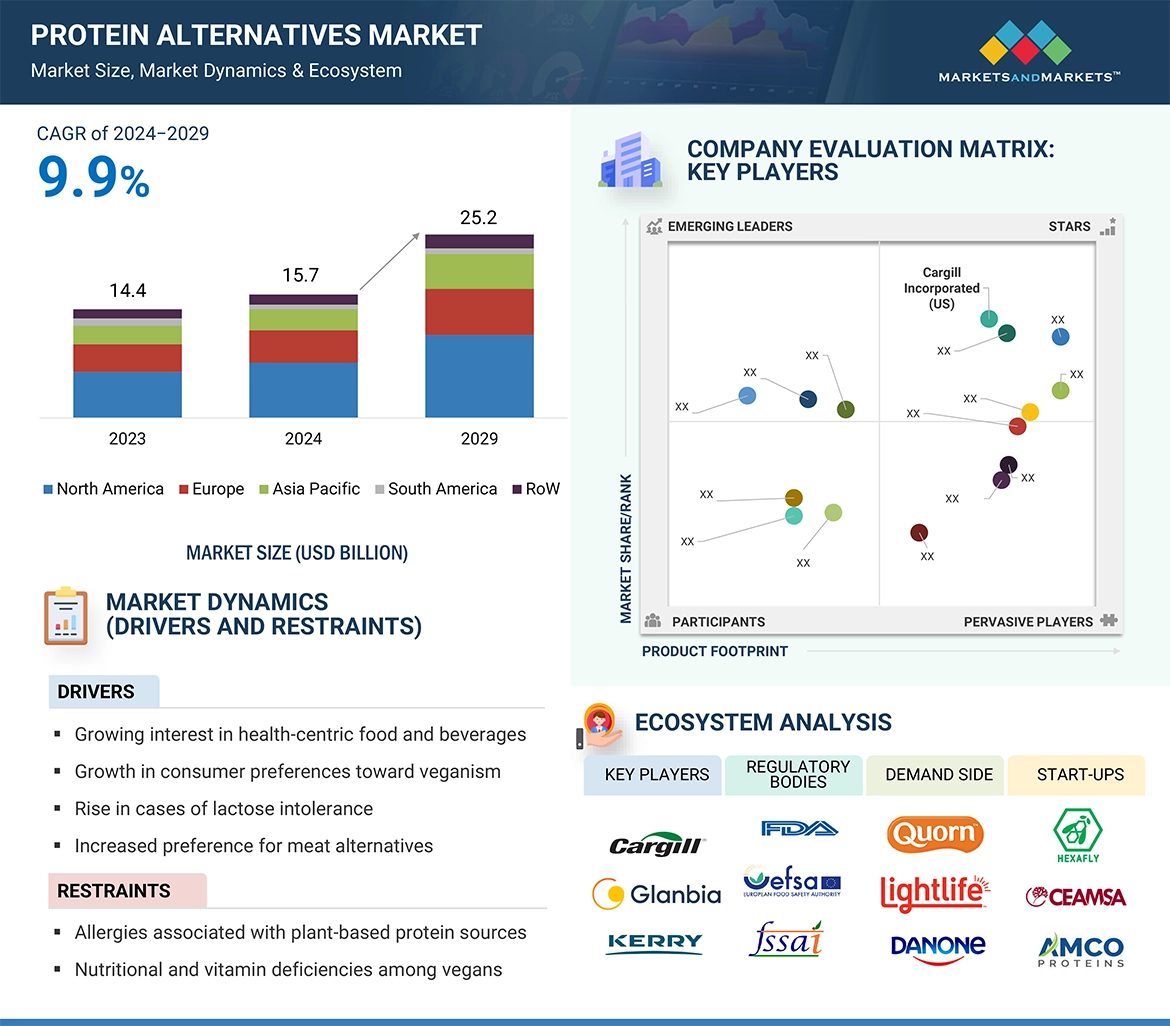

The global protein alternatives market is projected to reach USD 15.7 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 9.9%, reaching USD 25.2 billion by 2029. This market has seen significant expansion and diversification in recent years, driven by increasing consumer demand for sustainable, health-conscious, and ethically produced food choices. Key drivers include concerns over the environmental impact of traditional animal agriculture, the health benefits of plant-based diets, and ethical considerations regarding animal welfare. The market's primary segments include plant-based proteins, insect-based proteins, and microbial proteins. Companies like Beyond Meat, Impossible Foods, and Oatly have become mainstream brands, reflecting the widespread acceptance and expanding consumer base for these products. Technological advancements and substantial investments from both food industry leaders and venture capitalists have accelerated the development and accessibility of innovative protein alternatives.

Protein Alternatives Market Drivers: Growing Demand for Alternative Proteins

The expanding global population highlights the need for alternative protein sources. Over the past decade, significant efforts have focused on developing proteins from non-traditional crops and livestock. This trend is particularly prominent in Europe and North America, where consumer interest and investment in alternative proteins are on the rise. Traditional sources of animal protein, such as pork, beef, and chicken, are expected to be insufficient to meet future demand, creating opportunities for the insect protein market. In addition to proteins and fats, insects are valued for their rich mineral and vitamin content. Among younger populations, especially in sports nutrition, insect proteins, such as cricket flour, are becoming more popular and are being integrated into various nutritious food products. For example, startups like Next Step Foods in the UK produce cricket protein bars like "Yuana," which are available in several flavors. The shift to alternative proteins also offers environmental benefits, notably in reducing greenhouse gas emissions compared to conventional meat production, as emphasized by the World Economic Forum in 2019. Furthermore, alternative proteins address diet-related health concerns in developing nations and promote healthier lifestyles in developed regions like North America and Europe. These regions have already embraced alternatives such as edible insects, plant-based meat, plant protein ingredients, and cultured meat. Industry experts foresee substantial market growth for these products, with cultured and plant-based meats expected to grow by over 40% in the coming years. In 2022, a study funded by the European Regional Development Fund revealed that 22% of UK consumers preferred alternative protein sources over meat, with younger demographics showing an even higher preference of over 25%. These trends emphasize the growing opportunities in the insect protein sector.

Protein Alternatives Market Opportunities: Evolving Consumer Lifestyles

The expanding global population is placing increased pressure on limited resources, with rising energy costs and raw material expenses driving up food prices, especially for lower-income households. Additionally, water scarcity, particularly in Africa and Northern Asia, is intensifying the strain on food resources. In the Asia Pacific region, there is a cost advantage in production and processing, driving high demand and providing favorable conditions for dairy alternative manufacturers to target this market. As lifestyles rapidly evolve, there is a growing shift toward more nutritious and health-conscious food choices. Consumers are increasingly seeking quick yet wholesome alternatives, and the distinction between fast food and junk food is anticipated to widen. Recognizing naturally nutrient-rich products presents a significant opportunity for suppliers to meet changing consumer preferences. Furthermore, rising disposable incomes are fueling demand for convenient, healthy, and highly nutritious products in Asia Pacific countries, offering substantial growth opportunities within the protein alternatives market.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=233726079

The feed application in the protein alternatives market is expected to experience the highest CAGR during the forecast period.

The demand for alternative proteins in animal feed is steadily increasing, driven by rising consumption in developed countries. North America and Asia Pacific are major players in both livestock production and feed consumption. While plant-based sources have been used in the food industry for some time, there is a growing trend toward higher-quality protein-based feeds, such as isolates, improving feed quality. Insect proteins, increasingly used in poultry and aquaculture feeds, and microbial proteins, integrated into compound premixes for enhanced nutritional profiles, are gaining popularity. This shift to alternative protein sources in feed is driven by concerns over sustainable agricultural practices and reducing the environmental impact of future food production.

Plant Protein: Fastest Growing Segment

Plant protein has quickly become the leading segment in the protein alternatives market due to its widespread adoption and nutritional benefits. As consumers increasingly prioritize health, sustainability, and ethics, plant-based proteins offer an attractive solution. Unlike traditional animal proteins, which are associated with environmental and ethical concerns, plant proteins are typically more sustainable to produce and consume.

The rapid growth of plant protein in the market is driven by its versatility. Manufacturers can extract protein from various plant sources such as peas, soybeans, hemp, and algae, offering a diverse range of products that meet different dietary preferences and needs. This diversity fuels innovation, leading to products that not only match but sometimes outperform their animal-based counterparts in taste, texture, and nutritional profile. Additionally, plant protein's fast digestion and absorption make it appealing to athletes and health-conscious individuals seeking effective protein sources for muscle recovery and overall wellness. As research continues to highlight the health benefits of plant-based diets, such as reduced risks of chronic diseases, the popularity of plant protein is expected to keep rising in the protein alternatives market.

Asia Pacific Region Dominates the Protein Alternatives Market Share.

The Asia Pacific region holds the largest share of the protein alternatives market, driven by increasing consumer awareness of health benefits, immunity-boosting properties, and environmental sustainability. This shift away from traditional animal products reflects a growing recognition of the health benefits associated with plant-based diets, including lower risks of chronic diseases and improved immune function. At the same time, concerns over the environmental impact of animal agriculture, including carbon emissions and land use, are prompting consumers to adopt plant-based alternatives. This trend is supported by advanced food technologies that offer a wide range of plant-based protein products tailored to the region's diverse culinary preferences. As a result, the Asia Pacific region is emerging as a major force in the global protein alternatives market, poised for continued growth and innovation.

Top 10 Companies in the Protein Alternatives Market

Tate & Lyle PLC (London), Kerry Group PLC (Ireland), DSM Firmenich (Switzerland), ADM (US), Cargill Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland).