As the digital payment landscape evolves, Bitcoin continues to gain popularity for its anonymity and security features. In particular, automated Bitcoin payments are becoming a key solution for users looking for fast and efficient ways to complete transactions online. But how does a platform like Savastan improve this experience, especially in spaces like CVV shops?

CVV shops, which deal with selling credit card data, have long operated in the shadows of the internet. They present a unique set of challenges for both buyers and sellers—especially when it comes to payment methods. Traditional payment systems, like credit cards or PayPal, are often not an option due to the illegal nature of these transactions. This is where Bitcoin shines.

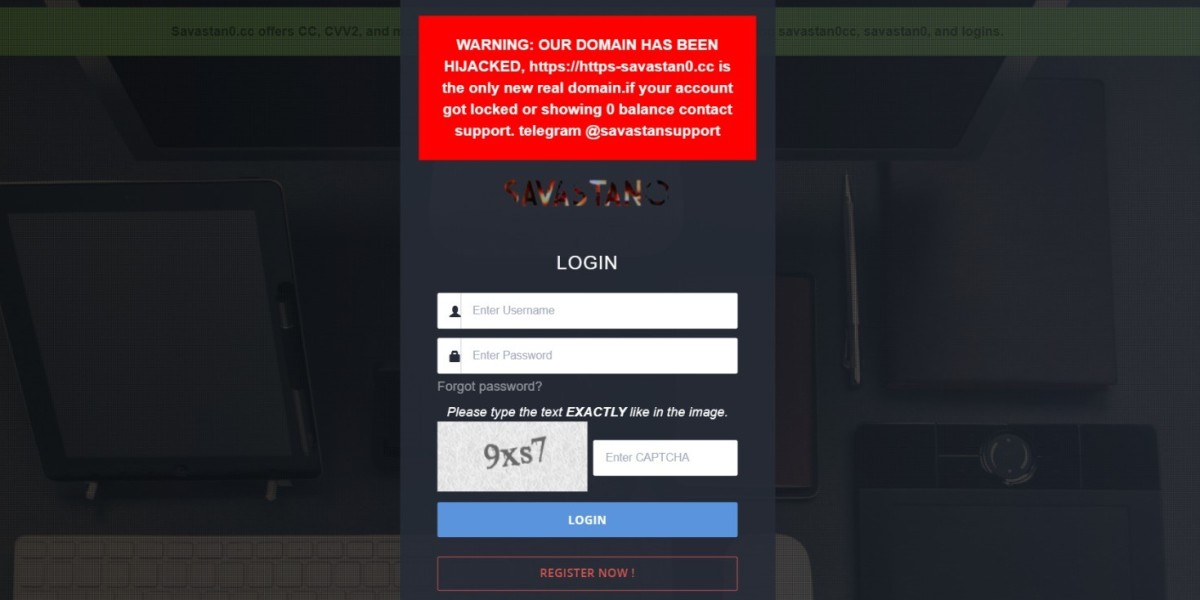

With Bitcoin's decentralized network, users can make payments directly without relying on intermediaries, adding an extra layer of security. But the process of manually sending Bitcoin for each transaction can be time-consuming and error-prone. That’s where automated systems like Savastan come into play. By automating Bitcoin payments, Savastan helps streamline the process, making it quicker and more efficient for users.

By removing the need for manual input, automated Bitcoin payments reduce the chances of human error and ensure transactions are completed faster. In high-speed environments like CVV shops, this is a major advantage. Users don’t have to worry about delays or mistakes, and transactions are processed instantly, allowing for smoother and more reliable purchases.

While Savastan and similar platforms offer significant benefits, users must still exercise caution. Engaging in CVV shops carries legal and security risks, and Bitcoin payments, while secure, do not guarantee immunity from fraud or legal consequences.

In conclusion, platforms like Savastan provide a much-needed service in the world of Bitcoin payments, especially in niche markets like CVV shops. However, it's important to always consider the potential risks involved. Are automated Bitcoin payments the future of digital transactions, or do the dangers of illegal markets outweigh the benefits?