An online invoice generator is more than just a tool for sending invoices. But even when you use free invoicing software for small business, it is better to have the habit of tracking your invoices. Efficient expense tracking ensures you have a vivid overview of where your money has been spent. Accurate financial records safeguard your business from going bankrupt. We have curated some productive insights for you to track your money flow. So you can protect your business from spending on non-profit projects or schemes.

Let’s explore the best practices to track your business expenses, even when you have free invoicing software for small business at your disposal.

Expense Tracking: The Heart of Business Success

Let me explain to you what expense tracking is. It is a systematic process of recording, analyzing, and managing all costs associated with a small business. You can record each expense you spend on office supplies, travel expenses, electric bills, repair works inside office buildings, vendor payments, employee salaries and so on. These expenses often slip through the cracks from your expenditure calculations. In the end, it gets messed up while tallying taxation.

To avoid this stress, every business has to maintain a separate record of their cash flow. Even though you have high-tech software to monitor your spending, it is a smart practice to keep a physical record as well. An invoicing software simplifies billing and payment processes. However, some users may prefer printed copies for bookkeeping. Proper expense tracking also plays a significant role in financial reporting. Therefore, it assists you in calculating profits and losses.

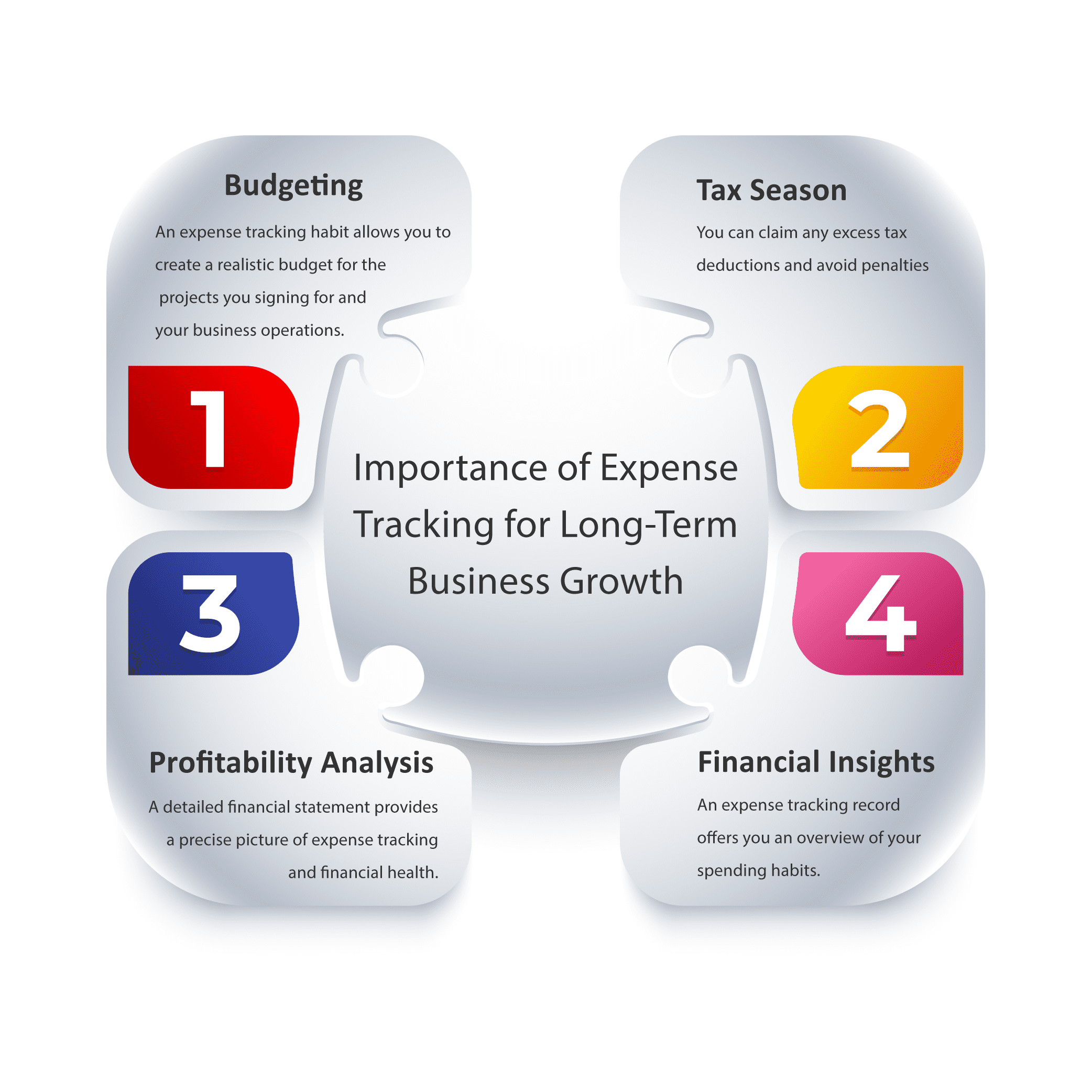

Why Expense Tracking Matters for Long-Term Business Growth

You can track your official business expenses for several reasons. It is essential to grasp why expense tracking matters. Sometimes you may leave tiny expenses while focusing on prominent works. It is better to know the significance of tracking in each section. Continue to read, you will be amused by its importance.

>> Awareness- You will be detailly informed on where you spent or lost your money.

>> Budgeting- This habit allows you to create a realistic budget for the projects you are signing for and your business operations.

>> Tax Season- A systemized organization in your bookkeeping will be your friend in need. You can claim any excess tax deductions and avoid penalties. So, you can avoid the stressful situation during tax season.

>> Financial Insights- An expense tracking record offers you an overview of your spending habits. Therefore, you can take effective measures in the areas of cost-cutting.

>> Cash Flow Management- Analyse the expenditure patterns of your company. Highlight the spot where the bar hits beyond its necessary budget allocation. These insights will aid you in making quality financial decisions.

>> Avoid Overspending- You can say an invoicing software does these operations for you. We didn’t say not to use them for your business purposes. An invoice generator does its work perfectly with a click. But, this will make you too lazy to take care of your overspending or unnecessary expenses.

>>Profitability Analysis- Knowledge about your expenses and casual spending molds your business to go in the way of profitability. A detailed financial statement provides a precise picture of expense tracking and financial health.

What gets measured gets managed. – Peter Drucker

How to Track Expenses Efficiently without Invoicing Software?

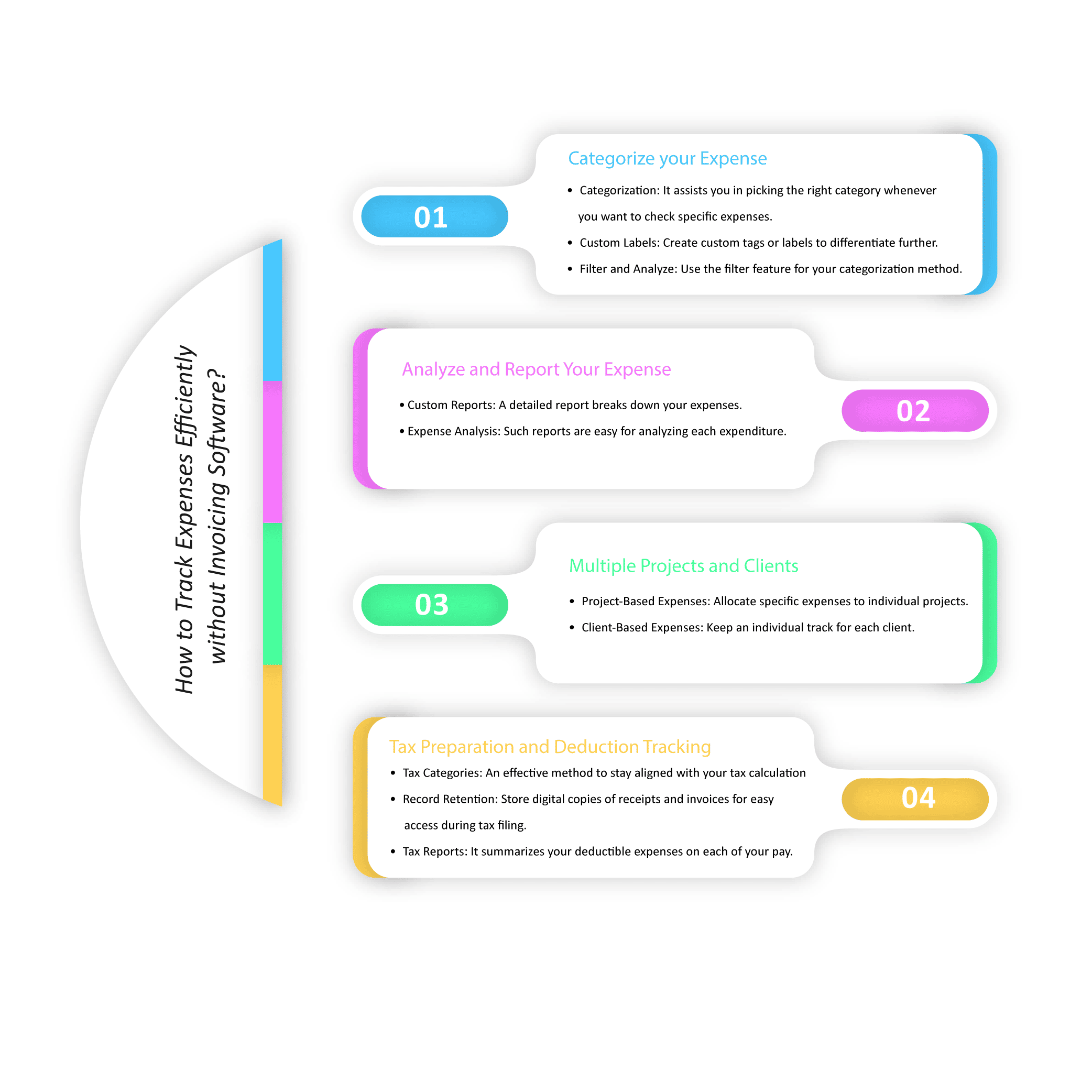

1. Categorize your Expenses

Tracking your business expenses is not only about recording them for tax purposes. It is a library of systematic records, categorization and analysis of expenditures over time. This will make reviewing your finances easier.

Driving Efficiency:

-Categorization: Categorize each of your expenses. It assists you in picking the right category whenever you want to check specific expenses. Some of the expense categories in a company are rent or maintenance, utility bills, marketing and advertisements, travel, payroll for your employees and the list never ends.

-Custom Labels: Create custom tags or labels to differentiate further. You can also entitle subgroups or subcategories for similar expenses.

-Filter and Analyze: Either in an invoicing software or you are maintaining an Excel sheet, use the filter for your categorization method. So, you can spot expenses by category, time frame, or vendor for better understanding.

This feature enables you to make informed decisions. You can keep up with business trends based on your expense data. Create an expense tracking module to identify cost-saving opportunities. Thus, you can improve budget planning strategies.

2. Analyze and Report Your Expense

A comprehensive report gives you an expansive view of the financial health of your business.

Driving Efficiency:

-Custom Reports: A detailed report breaks down your expenses by category, period, or other relevant metrics.

-Expense Analysis: Such reports are easy for analyzing each expenditure you have made for your business.

Finally, it becomes an efficient practice for you to identify the areas of excess spending. You can make bold financial decisions to adjust your budget based on your requirements.

3. Multiple Projects and Clients

Tracking expenses is crucial for multiple clients or project management. You can separate the allocation of budgets for each projAn infographic outlining four key methods for tracking expenses efficiently without invoicing softwareect or client without mixing up. Once you complete your ongoing projects, the separate documentation for the cost of each venture gives you accurate expense insights

Driving Efficiency:

-Project-Based Expenses: Allocate specific expenses to individual projects. This helps you to determine your profits and the total cost of your project or service.

- Client-Based Expenses: As we have mentioned earlier, keep an individual track for each client. Therefore, you can see how much you are spending on their projects.

These are a few simple techniques for effective cost management. So you know exactly how much a project costs as well as the revenue you have been generating.

4. Tax Preparation and Deduction Tracking

Accurate expense tracking is vital when it comes to tax season. A company or a person who is responsible for collecting tax details of your company has to keep detailed records of all deductible expenses. Then, you can be fully prepared when filing your taxes.

Driving Efficiency:

- Tax Categories: An effective method to stay aligned with your tax calculation is another critical function in business operation. As a professional, you can sort down each deductible expense into appropriate tax categories. So, you don’t have to sift through receipts.

- Record Retention: Store digital copies of receipts and invoices for easy access during tax filing.

- Tax Reports: When the time comes, it is crucial to generate year-end tax reports. It summarizes your deductible expenses on each of your pay.

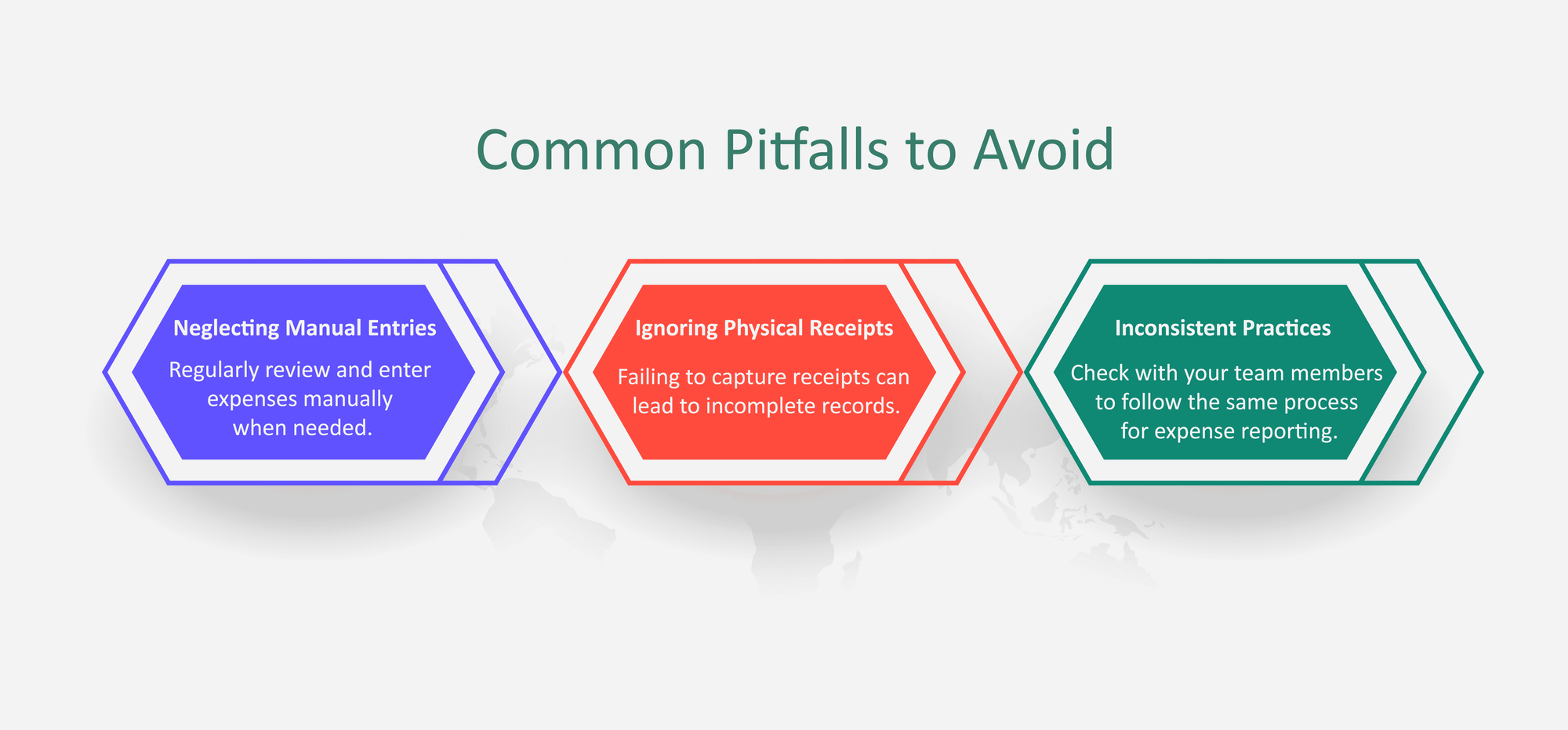

Common Pitfalls to Avoid

If you are using invoicing software to track your daily expenses for your business, there are common pitfalls to watch out for:

- Neglecting Manual Entries: Regularly review and enter expenses manually when needed.

- Ignoring Physical Receipts: Failing to capture receipts can lead to incomplete records.

- Inconsistent Practices: Check with your team members to follow the same process for expense reporting.

Bottom Statement

Being professional is essential for running a business for a long period. Every business organization has to make it a habit to check their transactions daily or weekly. This will ensure you catch any malpractices in your expense records. Whatever technology you use to automate expense tracking and other invoicing tasks, it is highly beneficial to spend a few minutes daily. So, it won’t feel like a huge task at the time of the tax season.

A pro tip for you is to use your smartphone to take pictures of physical receipts. Then, update them directly into your free invoicing software for small business for future reference.