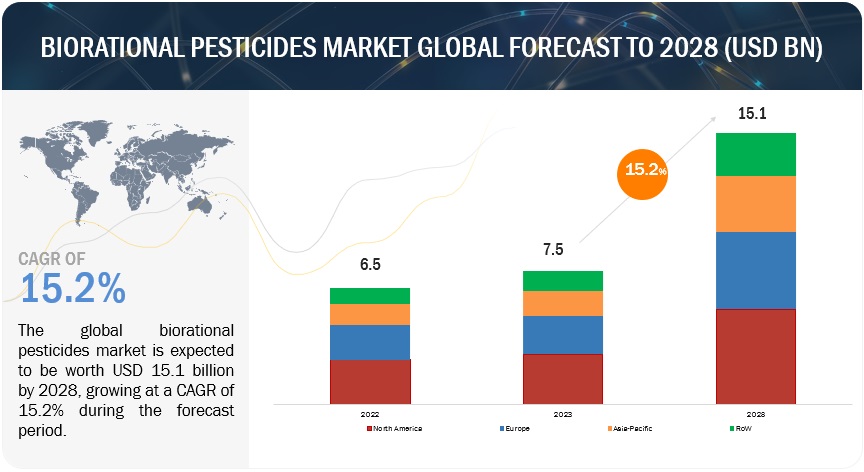

The biorational pesticides market size is expected to expand from USD 7.5 billion in 2023 to USD 15.1 billion by 2028, with a compound annual growth rate (CAGR) of 15.2% during this period. Growing awareness of the harmful impacts of synthetic chemical pesticides on ecosystems, biodiversity, and human health has driven a shift toward more environmentally friendly alternatives. Regulatory authorities are increasingly supporting biorational pesticides due to their lower toxicity and reduced environmental persistence compared to synthetic chemicals, which is fueling market growth.

Biorational Pesticides Market Drivers: Government Initiatives on Chemical Pesticide Bans and Public Awareness Programs

The detrimental impact of chemical pesticides on soil, the environment, and water bodies globally has driven a growing focus on promoting biopesticides in agriculture. This push includes awareness campaigns and supportive policies that encourage private sector involvement. Regions like South America, Asia Pacific, and Europe are witnessing rapid market growth, thanks to initiatives that promote the use and production of biorational pesticides among farmers and producers.

In North America, the Environmental Protection Agency (EPA) regulates bioinsecticides, biofungicides, and bionematicides—key categories of biopesticides—overseeing their registration and monitoring their effects on human health and the environment. The sale and distribution of biopesticides are governed by the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), which ensures food and feed remain residue-free under the Federal Food, Drug, and Cosmetic Act (FFDCA).

In India, the government has integrated bioinsecticides into its Integrated Pest Management (IPM) approach, which combines cultural, mechanical, and biological pest control techniques. Central Integrated Pest Management Centers (CIPMCs) promote this strategy, along with the judicious use of chemical pesticides when necessary, through programs like Farmers Field Schools and training initiatives. These government efforts play a pivotal role in advancing the biorational pesticides market, especially bioinsecticides, by underscoring the importance of sustainable pest management practices.

Biorational Pesticides Market Opportunities: Advancements in microbial research undertaken by key players across regions

Companies like Bayer AG (Germany) have made significant advancements in microbial and RNA interference (RNAi) technology, creating promising opportunities in the biorational pesticides market. Major industry players in crop protection have invested heavily in research, leading to the use of biological signals to trigger RNAi-specific genes. This innovation has the potential to enhance disease and pest resistance while improving crop yield and quality. A key development is the focus on creating sprayable RNAi products for biological crop protection. For example, Monsanto Company (before its acquisition by Bayer) received EPA approval in 2017 for a genetic engineering technology that uses RNA interference to combat insect pests. Additionally, Corteva Agriscience (US) secured licenses for two insect traits from Monsanto, including an RNAi rootworm trait. The growing adoption of this technology in the industry offers a novel solution, especially for managing rootworm traits.

What are the key benefits of using microbials in biorational pesticide production?

The growth of the biorational pesticides market is driven by the use of microbials such as bacteria, fungi, viruses, and protozoa to create environmentally sustainable pest control solutions. These microorganisms work through specific modes of action, effectively targeting pests while reducing the impact on the environment and non-target species. They are formulated into various products, including microbial-based insecticides, fungicides, and nematicides.

For example, Bacillus thuringiensis (Bt), a well-known microbial insecticide, highlights the market's commitment to eco-friendly solutions. Bt produces insect-toxic proteins that specifically target certain pests without posing risks to humans, animals, or beneficial insects. Bt-based products, widely used in agriculture and mosquito control programs around the world, illustrate the market's shift toward sustainable pest management practices.

Asia Pacific's Biorational Pesticides Market Expected to Experience the Highest CAGR During the Forecast Period.

The Asia Pacific region is expected to experience the highest Compound Annual Growth Rate (CAGR) in the market from 2023 to 2028, driven by the increasing adoption of eco-friendly pest control solutions. Japan's "Organic Village" initiative, spearheaded by the Ministry of Agriculture, Forestry and Fisheries (MAFF), aims to boost the organic farming share to 25 percent by 2050. This initiative reflects a strategic push toward organic practices, likely fueling the demand for biorational pesticides in the region.

Similarly, China's “14th Five-Year Plan for National Economic and Social Development” underscores a growing focus on organic and sustainable agriculture. The plan highlights efforts to enhance green agricultural standards and strengthen certification for green food, organic products, and geographical indications. This commitment to eco-friendly farming is expected to increase demand for biorational pesticides in China, positively impacting the growth trajectory of the Asia Pacific market.

Top Biorational Pesticides Companies:

The key players in this include BASF SE (Germany), Bayer AG (Germany), UPL (India), FMC Corporation (US), Syngenta AG (Switzerland), Novozymes A/S (Denmark), Sumitomo Chemical Co., Ltd (Japan), Pro Farm Group Inc (US), Koppert (Netherlands), Valent BioSciences LLC (US), Gowan Company (US), Certis Biologicals (US), Biobest Group (Belgium), BIONEMA (UK), and Vestaron Corporation (US).

Key Questions Addressed by the Biorational Pesticides Market Report:

- Which are the major companies in the biorational pesticides market? What are their major strategies to strengthen their market presence?

- What are the drivers and opportunities for the biorational pesticides market?

- Which region is expected to hold the highest market share?

- Which are the key technology trends prevailing in the biorational pesticides market?

- What is the total CAGR expected to be recorded for the biorational pesticides market during 2023-2028?

Schedule a call with our Analysts to discuss your business needs:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=57324225